Rental Market Update: What Falling Rents, Rising Vacancies, and Longer Lease-Up Times Mean as We Head Into 2026

As we close the door on 2025, national rental market data paints a clear picture: the market remains soft, competitive, and highly seasonal. While headlines often focus on isolated hot spots, the broader story is one of easing rent pressure, elevated vacancy rates, and longer leasing timelines across much of the country.

Here’s what property owners should know, and how to position their rentals wisely moving into early 2026.

Rents Continue to Slide Heading Into Winter

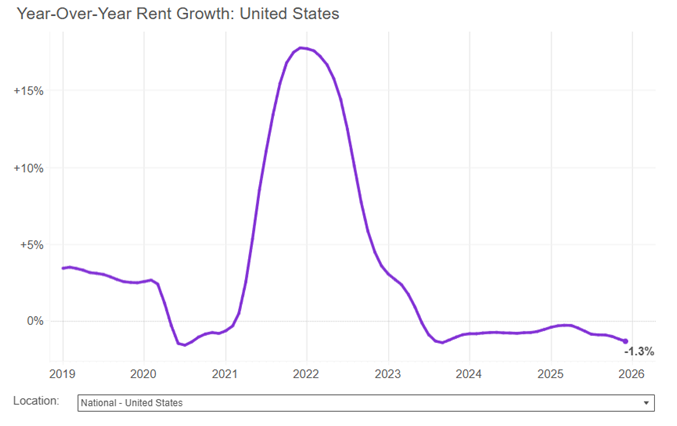

The national median rent fell 0.8% in December, landing at $1,356. That marks five consecutive months of rent declines to end the year. Compared to December 2024, rents are now down 1.3% year-over-year.

This downturn is partly seasonal. Winter is traditionally slower for renter movement, which naturally softens pricing. However, the past few years have amplified this effect. Since peaking in mid-2022, national rents have declined 5.9% total.

It’s important to keep that in context: despite recent declines, today’s rents are still 19% higher than they were at the end of 2020, following the historic rent surge of 2021–2022.

Based on recent seasonal patterns, we expect another one to two months of modest declines before rent growth begins to stabilize and turn positive in the spring.

Seasonality Has Shifted and Owners Need to Adjust

One notable change is when rent growth happens. Before the pandemic, May was typically the strongest month for rent increases. Over the last three years, March has emerged as the peak, with rents cooling earlier in the summer than they once did. We’ll be watching the market closely to see if this holds true this year.

We’ve seen that negative rent growth is now arriving closer to August instead of September, tightening the window for pricing power. Owners who rely on outdated seasonality assumptions may find themselves overpriced at the wrong time of year.

Vacancy Rates Hit a New High

The national multifamily vacancy rate reached 7.3%, the highest level recorded since tracking began in 2017.

The primary driver? A historic surge in new apartment construction.

Over 600,000 new multifamily units were delivered in 2024—the most in nearly 40 years. Anderson is not exempt from the number of both new units and the addition of existing owner-occupied units transitioning to rental units

While construction has slowed from its peak, new supply remains well above long-term averages.

Units still under construction suggest the market hasn’t fully absorbed this inventory yet.

More available units mean more competition for renters and less pricing leverage for owners, especially in oversupplied markets.

Properties Are Taking Longer to Lease

As vacancies rise, so does the time it takes to fill them.

The average list-to-lease time reached 39 days in December, a new record high. That’s:

3+ days longer than last year

More than double the pace of summer 2021, when units were leasing in about 18 days

Longer vacancy periods can quietly erode returns through lost rent, increased marketing costs, and price reductions, making professional pricing and leasing strategy more important than ever.

Rent Declines Are Concentrated in the Sun Belt

Rent softening is not evenly distributed across the country.

Among large metro areas (population over one million):

Rents fell month-over-month in 51 of 54 markets

Rents are down year-over-year in 33 markets, primarily in the South and Mountain West

The sharpest declines are concentrated in high-construction Sun Belt metros. Austin continues to lead the nation in softness, with rents down 6.6% year-over-year and more than 20% below its 2022 peak. Other metros with significant declines, such as Denver, Phoenix, Dallas, and Orlando, share a common factor: heavy new supply.

What This Means for Property Owners in 2026

As we move into the first half of 2026, several themes are likely to persist:

Elevated competition among rentals

Pricing sensitivity from renters

Longer leasing timelines, especially outside peak season

Much depends on rental demand, which remains uncertain amid labor market weakness and broader economic volatility. If demand slows further, it may take longer for the market to absorb the excess inventory even as new construction tapers off.

The Bottom Line

This is no longer a “set it and forget it” rental market.

Success in 2026 will favor owners who:

Price proactively, not reactively

Prepare homes to stand out in crowded markets

Adjust strategy based on local data—not national headlines

A disciplined, data-driven approach to pricing, marketing, and leasing will be the difference between prolonged vacancies and stable performance as the market works its way toward balance again.

In a market defined by rising vacancies, longer lease-up times, and shifting seasonality, professional pricing is no longer optional; it’s essential. Overpricing a home by even a small margin can mean weeks of additional vacancy, while underpricing leaves money on the table in an already competitive environment.

At Foothills Property Management, we don’t rely on guesswork or generic online estimates. Our pricing strategy is built on:

Hyper-local market data

Current active competition (not outdated comps)

Seasonality and demand trends

Real-time leasing performance

We continuously monitor showings, inquiry volume, and days-on-market to make data-backed adjustments quickly, helping properties lease faster while protecting long-term rental value.

If you’re unsure whether your rental is priced correctly for today’s market or want a second opinion as conditions continue to shift, reach out to Foothills Property Management for a professional rental pricing analysis. The right strategy now can save months of lost rent later.